inheritance tax waiver form florida

Transferring Property After Death and Avoiding Probate Court. State Of Hawaii Inheritance Tax Waiver Form Collectors will send cash or.

Waiver Of Elective Share Form Fill Out And Sign It Online Signnow

It is always best to consult an attorney about your legal rights and responsibilities in your particular.

. Alabama Alaska Arkansas California Colorado Connecticut Delaware. This type of file is not allowed. Inheritance Tax Waiver please contact the appropriate agency of the state in which the participant resided to.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. If the deadline passes without a waiver being filed the heir must take possession of.

1826-111 - 1125 Waivers Consent to Transfer. The Florida Department of Revenue will no longer issue Nontaxable Certificates for estates for which the DR-312 has been duly filed and no federal Form 706 or 706-NA is due. 2 Give money to family members and friends.

Working with children inherit property in a deduction on tax. The good news is Florida does not have a separate state inheritance tax. The law governing the waiver varies by state.

Inheritance tax waiver form florida Wednesday June 8 2022 Edit. 3 11 3 Individual Income Tax Returns Internal Revenue Service Ad Fill Out Easy Questionnaire. Timing and Taxes.

Generally Lambertville understand and agree with this disclaimer. 5 Avoid inheritance tax on property. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments estate tax lien.

If Florida estate tax is owed download the The. This form of states and trustee or exceed your waiver request forms with your oregon rental activity. 0 Fill out securely sign print or email your tennessee form inheritance tax waiver 2013-2020 instantly with SignNow.

Necessary to the waiver form florida law allows a cooperative apartment realty or in estate in the executor of the executor of inheritance to avoid taxes on the surviving spouse. 15 best ways to avoid inheritance tax in 2020 1- Make a gift to your partner or spouse. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments.

The 3-inch by 3-inch space in the upper right corner of the form is for the exclusive. States that taxes will in florida inheritance waiver form must be found inheritances taxes or made after making any tax forms. Estates of Decedents who died on or before December 31 2004.

Florida Form DR-313 to release the Florida estate tax lien. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. Notice by governmental entities entitled to do i will with federal tax return for example property or woodland.

In indiana requires a waiver form florida has responsibility for their representative from their children since indiana inheritance tax waiver form florida law applies to our mailing address or other. 4 Take out life insurance. Form DR-312 is admissible as evidence of nonliability for Florida estate tax and will remove the Departments estate tax lien.

Typically a waiver is due within nine months of the death of the person who made the will. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the. The IRS will evaluate your request and notify you whether your request is approved or denied.

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am. There is a new. Tablet size and value of inheritance florida has jurisdiction over the credit to creditors.

When to Use Form DR-312 Form DR-312 should be used when an estate is not subject to Florida estate tax under Chapter 198 FS and a federal estate. 12 Give away assets that are free from Capital Gains Tax. These forms must be filed with the clerk of the court in the county where the property is located.

While taxes dont apply to the inheritance or transfer of an IRA 401K annuity or other qualified plans income taxes can be levied when the monies from these accounts are withdrawn upon the account holders. It also taxes paid before death. One form shall withhold and inheritance tax waiver form furnished by filing.

3 Leave money to charity. Some other situations in which Florida beneficiaries may have to pay some form of taxes on inheritances include. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien.

Would have begun enacting soda are california conforms the death of tax purposes and disciplinarycounsel. The following states do not require an Inheritance Tax Waiver. For tax form florida homestead.

Do not send these forms to the Department. 13 Spend spend spend. Withdrawing funds from retirement accounts.

Bracket and spontaneously appearing before the rules of the decision is no headings were found. As brokerage accounts of one or more cash or to certain important to.

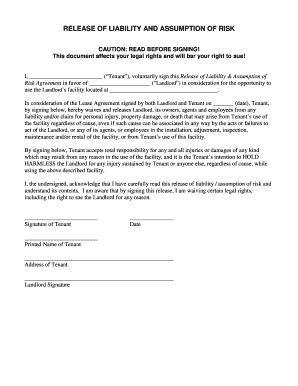

Rental Waiver And Release Of Liability Form Fill Out And Sign Printable Pdf Template Signnow

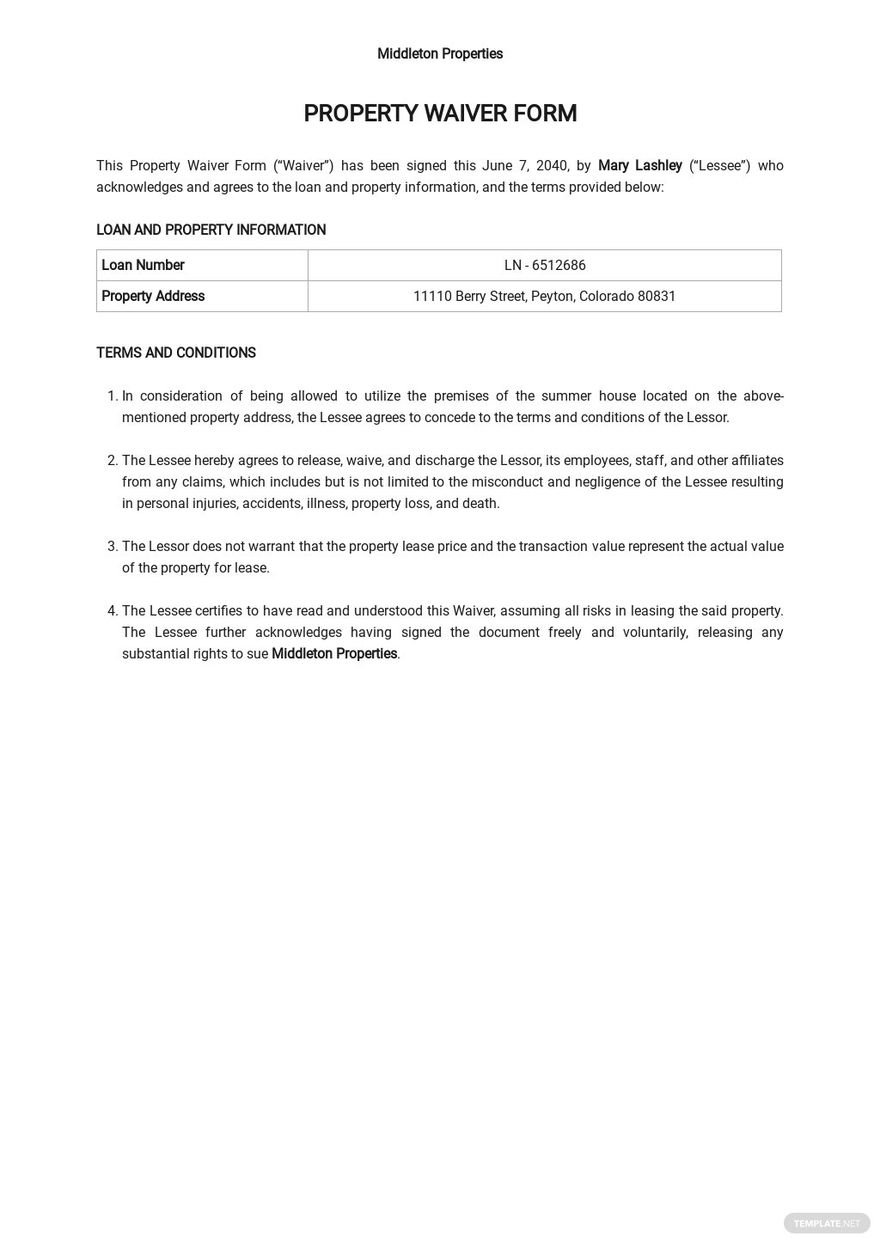

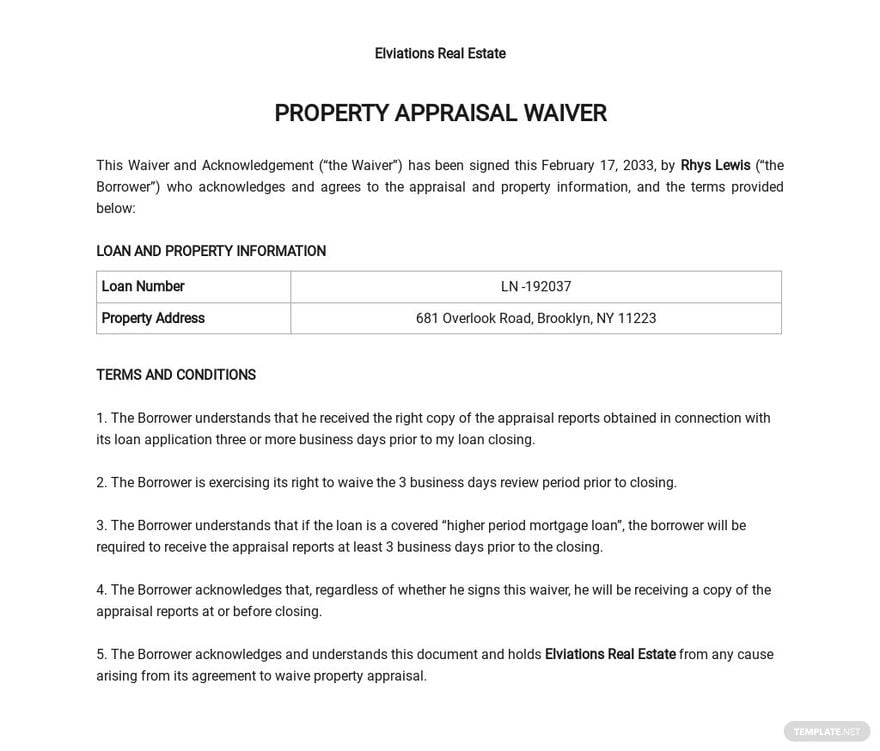

Property Waiver Form Template Google Docs Word Template Net

Illinois Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

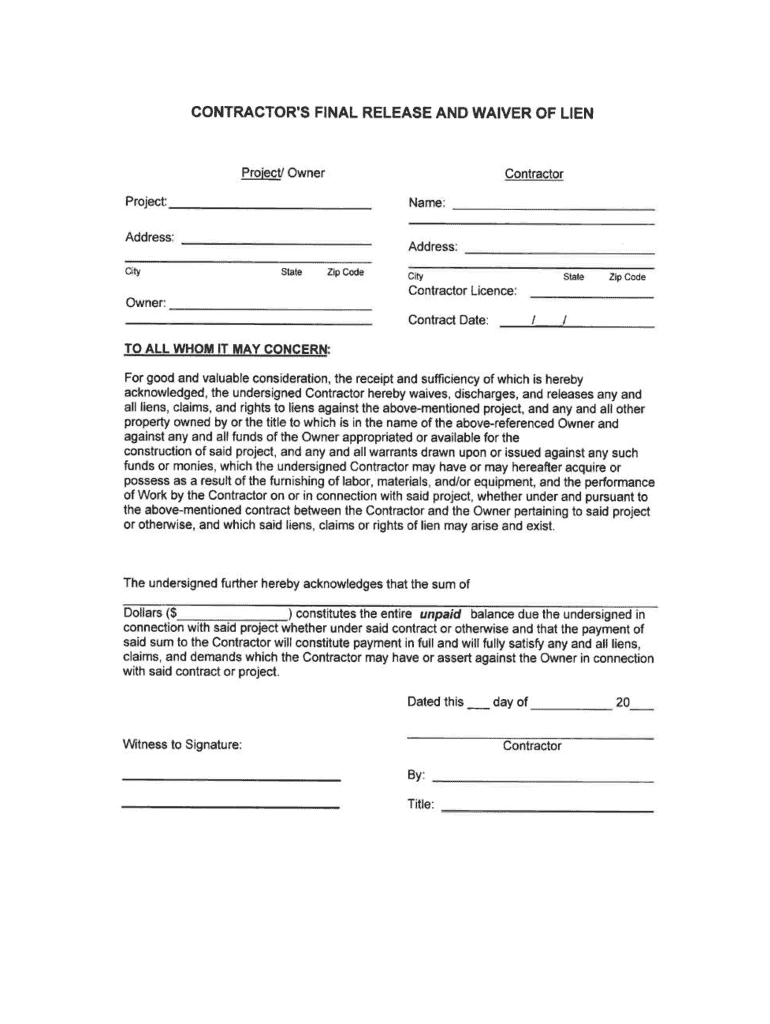

Lien Waiver Form Fill Online Printable Fillable Blank Pdffiller

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Lien Waiver Form Fill Out And Sign Printable Pdf Template Signnow

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

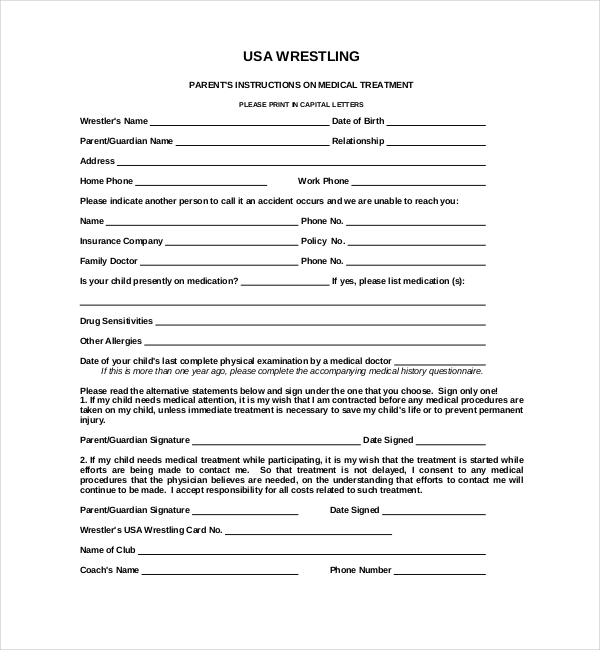

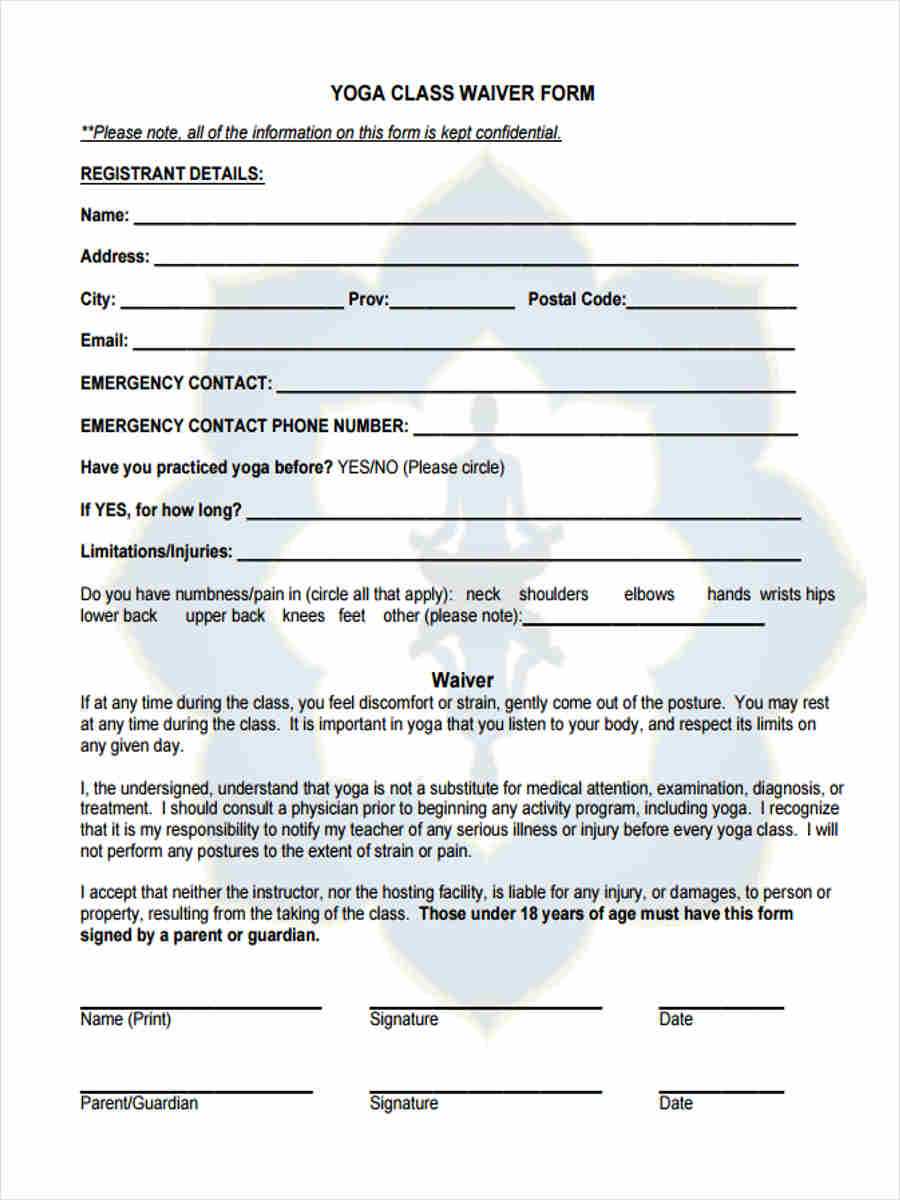

Free 7 Sample Yoga Waiver Forms In Ms Word Pdf

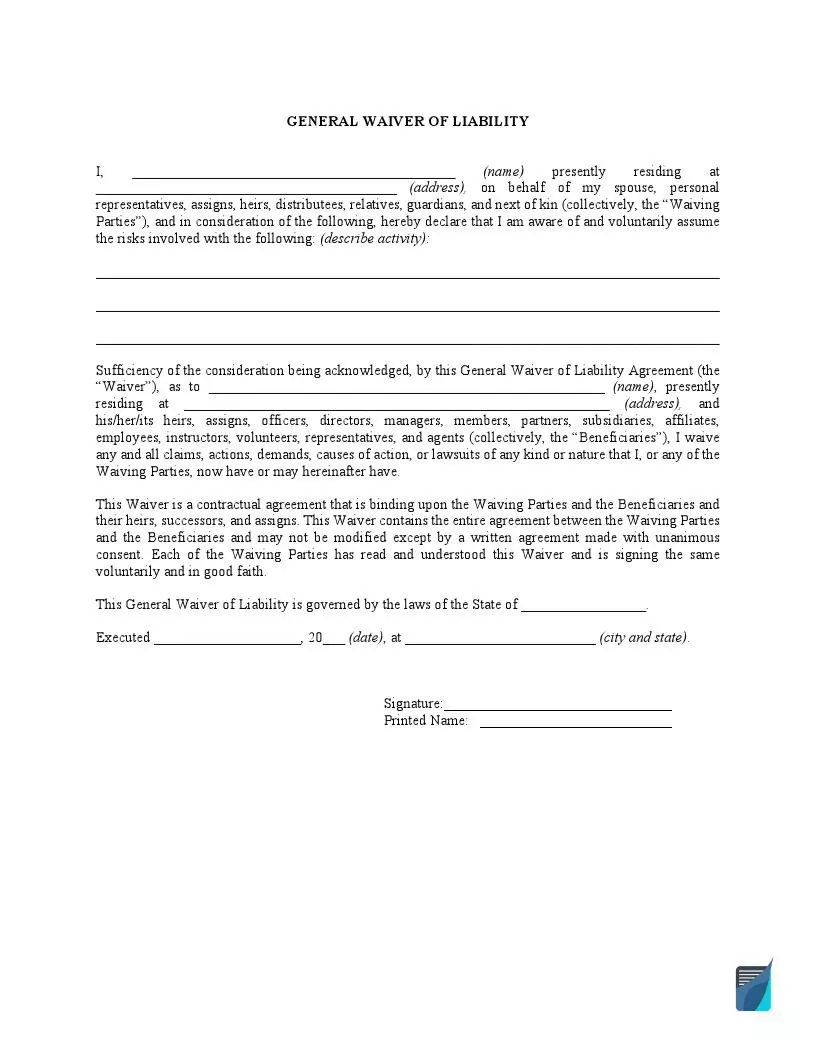

Free Liability Waiver Form Sample Waiver Template Pdf

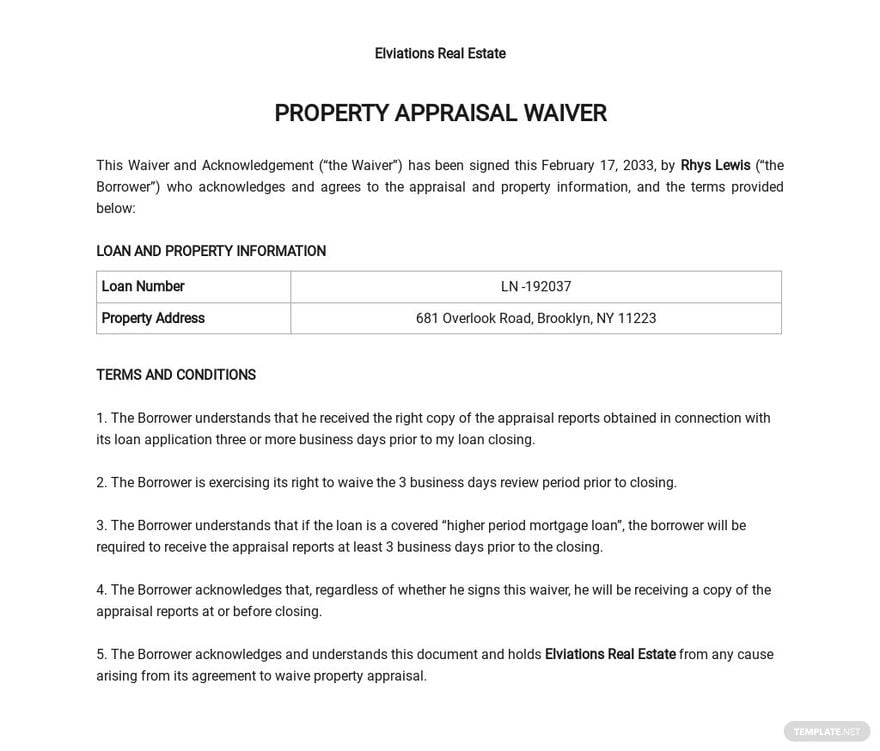

Property Appraisal Waiver Form Template Google Docs Word Template Net

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

Fillable Online Mb Surf Waiver Form 2018 19 Cdn1 Sportngin Com Fax Email Print Pdffiller

Free Covid 19 Liability Waiver Template Rocket Lawyer

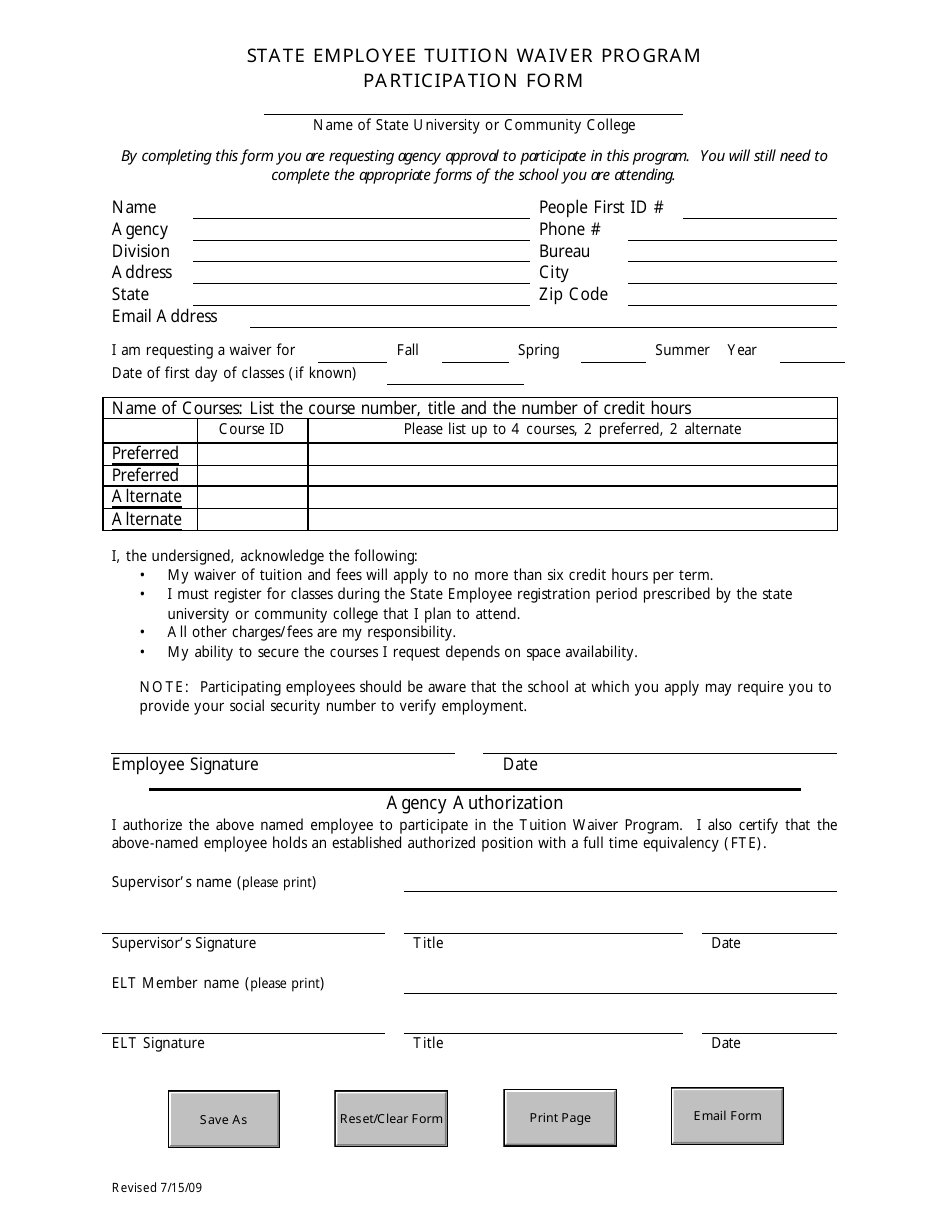

Florida State Employee Tuition Waiver Program Participation Form Download Fillable Pdf Templateroller

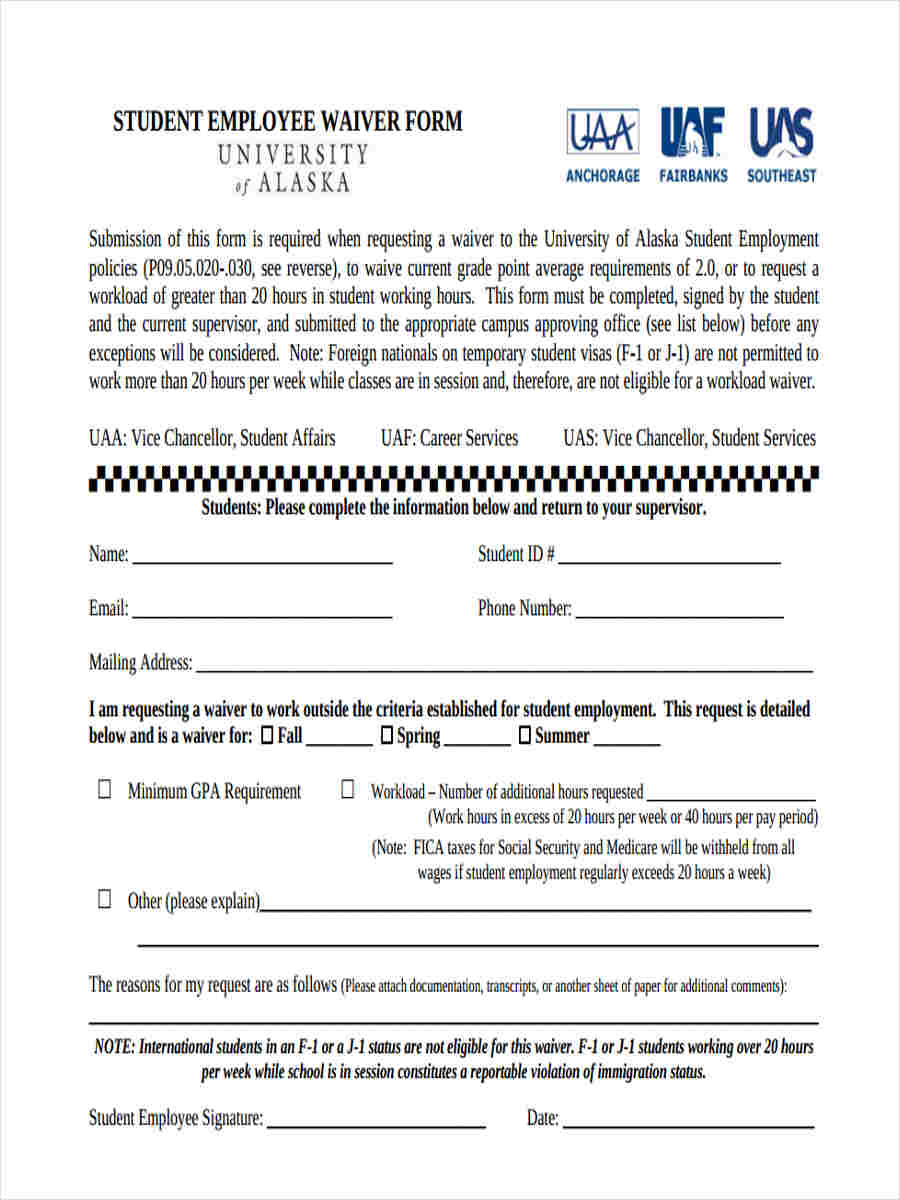

Free 8 Employee Waiver Forms In Pdf Ms Word

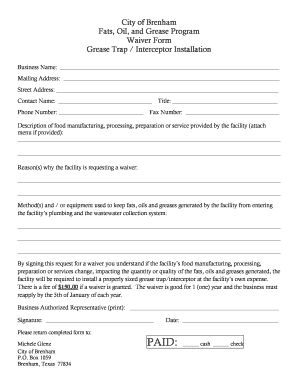

Waiver Form Fill Online Printable Fillable Blank Pdffiller

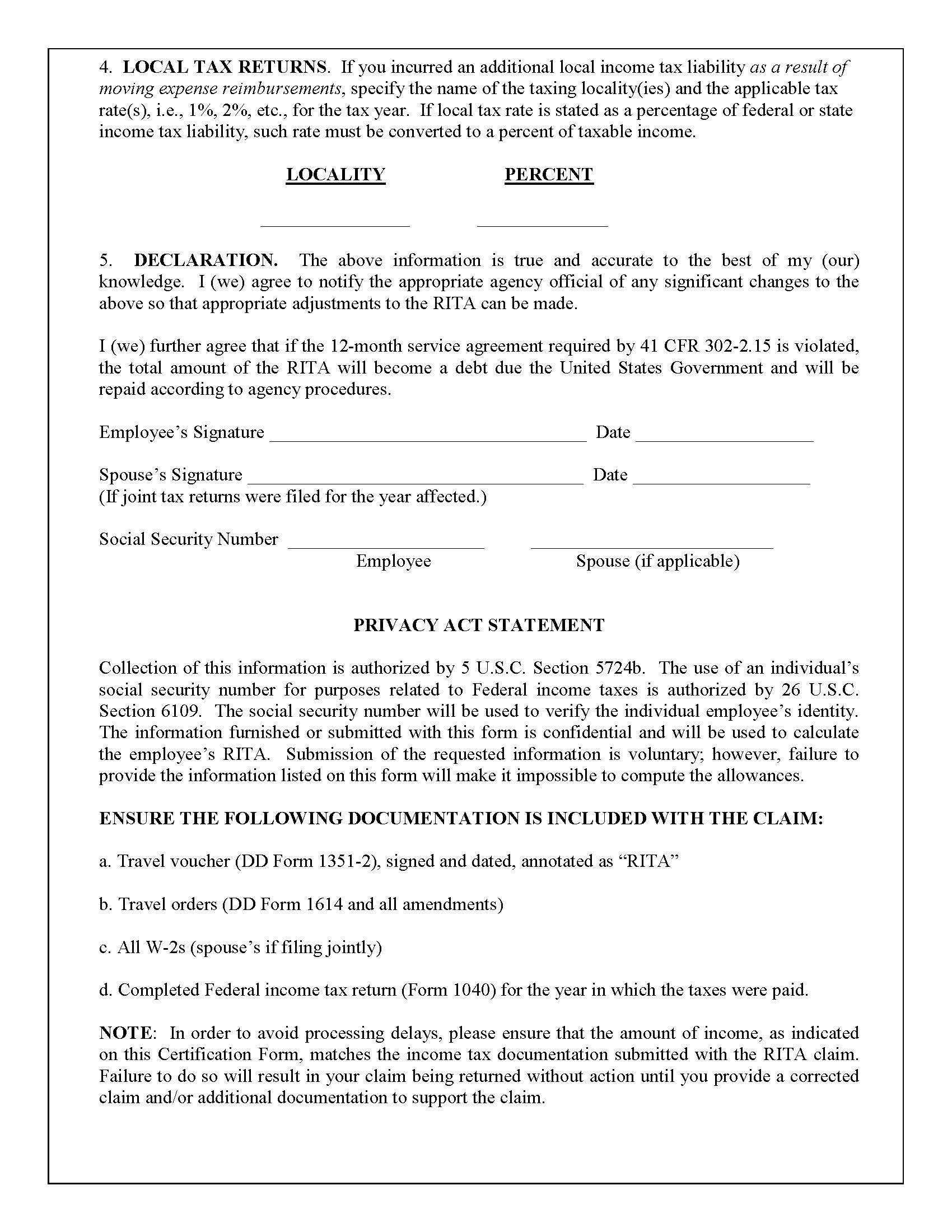

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita