how long can you short a stock td ameritrade

Step 2 Select Whether Youre Buying or Selling. A new ticket will appear with three orders that need to be filled.

How To Use Stock Charts W Td Ameritrade 6 Mins Youtube

Account Minimum 224 4.

. Stocks and ETFs come with 0 commissions. You will specify that you are planning to short the stock. Enable the account for short selling.

If you sell a stock then buy a stock that is similar within 30 days you will not get the tax benefit that accrues with regular transactions. Enter Your Order to Sell Short 223 3. This works similar to other websites that allow short trading.

Futures will cost a little more at 225. Spread orders allowed include. You can buy and sell the same stock on the same day but there is one tax rule you must consider.

For the trade type select OTOCO one triggers order cancels other. If an investor is not considered a day trader it is still possible to buy and sell stock in the same day. Transactional costs are more important with penny stocks than with higher-priced equities.

Short selling involves having a broker who is willing to loan stock with. Level 1 1y This is how stocks start to become a problem for some people 3 level 1 1y Are you approves for short selling on TD ameritrade. If this happens you may be required to post additional cash to your account to cover the full short balance as if you were.

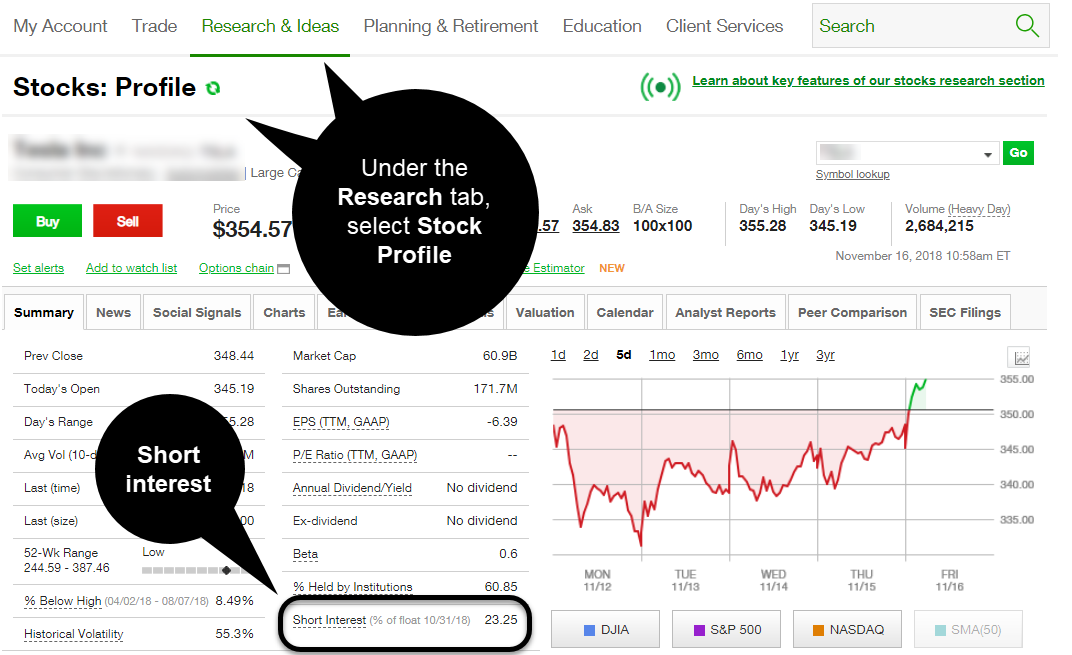

For example a combination of high short interest and a drop below the 52-week low or the 200-day moving average might indicate look out below Long and Short. 3 level 1 1y You ever think about just doing long puts. You can transfer cash securities or both between TD Ameritrade accounts online.

The firm currently charges 95 interest on a margin account. Stocks That Cant Be Traded By TDA 225 5. But you can reach out and find out.

TD Ameritrade Hard To Borrow Interest Rate Margin interest could be charged in some cases. You can also view whether your positions are categorized as long term or short term. How to short stock w Td Ameritrade 3 minFacebook.

Your broker borrows the shares fills your order and places them into your account. 0 stockETF trades and a transfer fee refund. You can make a one-time transfer or save a connection for future use.

You place an order to sell short 100 shares of stock XYZ at the price of 40. I doubt theyll allow you to trade on margin from their short list with only 4K. Currently TD Ameritrades margin schedule ranges from 11 to 825.

You can potentially do the same by learning how to take a short position. In this strategy the short put is secured by cash or available funds in the account Youll also discover how to calculate the upside potential as well as how to manage the risk of cash-secured puts. You will apply for margin trading sign documents acknowledging the risks of margin trading and get approved to trade.

A brokerage account comes with zero fees. Not too much TD Ameritrade charges 0 for its advanced trading tools. Connect your accounts for internal transfers Go to My Account Deposits Transfers AccountBank Connections and select TD Ameritrade Account In some cases we may ask you to print complete and return a form.

Heres how short selling can work in practice. This is known as a forced buy-in. Short interest can also be applied alongside chart indicators such as moving averages for signals on when it may be time to get out of a stock.

Stock XYZ falls in price to 35. This article will show you how to get started. There are no limitations on long calls and long puts for this stock.

More answers below Brian Flanagan Author has 46K answers and 4678K answer views 2 y. TD Ameritrade and its subsidiary - Thinkorswim - do NOT have additional fees and surcharges on stocks priced under 1To penny stock orders applies flat-rate commission rate of 0 per trade if stock is listed in on a US. Options will cost 65 cent per side per contract.

According to regulation t you can make as many day trade round trip stock purchases using a cash account as long as you have the funds to cover each and every round trip sale. How Long It Takes to Enable Your Account for Short Sales 226 6. TD Ameritrade will also mark to market your short positions at the end of each day meaning that if the position moves against you the stock price increases your short balance will become more negative and your short position will reflect an unrealized loss.

Take note however that a lot of the options available on Navigator are geared toward active traders. 22 7 Steps to Shorting a Stock With TD Ameritrade as an example 221 1. The first one is the sell order.

After you short the stocks your brokerage may require you to close the position at any time as they may no longer be able to lend you the shares. If the price of that stock drops to 80 you can buy it back at that price return the stock to your brokerage company and keep the 20 difference as profit. You sold at 40 and decide to capture the profit.

Cancel Continue to Website. Enable Your Account for Margin Trading 222 2. Enter the symbol and select sell for the action.

This is the opposite of a traditional long position where an investor hopes to profit from rising prices. This may take up to 3 days. Custom spreads are not allowed but standard spread orders are allowed.

Say youve identified a stock that currently trades at 100 per share. If you see sell short choose this option. Learn how selling a cash-secured put obligates you to buy shares of stock for a specific price for a set amount of time.

Open TD Ameritrade Account Step 1 Enter the Stock Symbol Enter the symbol of the stock or ETF you want to buy in the Quote box at the bottom of the screen to see its last asking and bid prices. The stock goes to 1150 so my stop loss is triggered. Trade Ideas Scanners Best Scan.

TD Ameritrade Short Selling Fees Interest Rate Shorting a stock or ETF carries the same fee as a purchase. You Cant Reserve Shares To Short 227 7. Theyre Both Part of Price Discovery.

There is no mandated limit to how long a short position may be held. The OCO group has a stop limit at 18 and a stop loss at 12. Award-winning broker TD Ameritrade.

There is no time limit on how long. A simple example of a short-selling transaction. Verticals BackRatio Calendar Diagonal Straddle Strangle Covered Stock Collar Butterfly Combo Condor Iron Condor Vertical Roll Collar with Stock Double Diagonal and Double Calendar.

Is there a way to now be short the stock. You are now net short 4000 worth of XYZ stock 100 shares at 40 4000. So for example I buy Stock X market for 15 as part of an OCO group.

If I have a stop loss set at a value and the price goes below the value can I then open a short position that is automatically part of its own OCO group.

Dashboard Td Ameritrade Mobile Iphone Youtube

Td Ameritrade Alternatives For 2022

A Beginner S Guide To Td Ameritrade S Thinkorswim Money

Td Ameritrade Review 2022 Pros Cons And How It Compares Nerdwallet

How To Short Sell A Stock Td Ameritrade Think Or Swim Youtube

Td Ameritrade Network Tdanetwork Twitter

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

:max_bytes(150000):strip_icc()/InteractiveBrokersvs.TDAmeritrade-5c61bc95c9e77c0001d321da.png)

Interactive Brokers Vs Td Ameritrade

Getting Started At Td Ameritrade Youtube

How To Buy Sell Options W Td Ameritrade 4mins Youtube

Td Ameritrade Curbs Gamestop Trades As Frenzy Snags Brokers Bloomberg

How To Write A Covered Call On The Td Ameritrade Mobile App Youtube

Td Ameritrade Review 2022 Day Trading With 0 Commissions

The Short And Long Of It Your Top Questions On Short Ticker Tape

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

/td_ameritrade_productcard-5c61ed44c9e77c000159c8f6.png)

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)